Unlock Valuable Customer Feedback: Your Guide to Effective Surveys

In today’s hyper-competitive marketplace, simply meeting customer expectations is no longer enough. Businesses must actively listen and learn from their customers to innovate, improve, and build lasting loyalty. This is where customer feedback surveys become an indispensable tool. They provide direct insights into customer sentiment, experiences, and unmet needs, transforming raw opinions into actionable intelligence.

But effective surveying isn’t about asking vague questions or simply collecting data for the sake of it. It requires a strategic approach, thoughtful question design, and a commitment to acting on the results. This guide will equip you with everything you need to know to leverage customer feedback surveys effectively, turning customer voices into powerful drivers of business success.

The Power of Customer Feedback: Why Surveys Matter

Customer feedback is the lifeblood of any customer-centric organization. It offers a direct pipeline to understanding your customers’ true thoughts, feelings, and needs. However, feedback can come in many forms – social media comments, direct emails, support interactions, and direct customer feedback surveys. While all are valuable, structured surveys offer unique advantages.

1. Structured Insights & Measurable Data: Surveys provide a standardized way to collect feedback, making it easier to quantify responses, identify trends, and measure changes over time. This objectivity allows for more reliable analysis compared to anecdotal feedback.

2. Reach a Broad Audience: Unlike waiting for customers to reach out via email or social media, surveys can be distributed widely and efficiently to a large number of customers simultaneously, ensuring a more representative sample.

3. Understanding Nuance and Sentiment: Well-crafted survey questions can delve deeper than simple praise or criticism. They can uncover the reasons behind customer satisfaction or dissatisfaction, highlighting specific pain points, areas of strength, and opportunities for improvement.

4. Identifying Key Areas for Improvement: Customer feedback surveys pinpoint specific areas within your products, services, processes, or support that require attention. Whether it’s a technical issue, a confusing checkout process, or a lack of feature X, survey data provides concrete evidence to guide your improvement efforts.

5. Demonstrating Commitment to Customers: Actively seeking feedback through surveys signals to your customers that you value their opinions and are dedicated to continuous improvement. This fosters a sense of partnership and enhances brand loyalty.

6. Informing Strategic Decisions: Beyond immediate operational improvements, survey insights can inform broader strategic decisions, such as product development roadmaps, service expansions, pricing adjustments, and marketing campaign effectiveness.

Mastering the Art of the Survey: Implementation and Best Practices

While the benefits are clear, the effectiveness of your customer feedback surveys hinges on how they are designed, deployed, and interpreted. A poorly constructed survey can confuse respondents, yield biased data, and fail to deliver actionable insights. Follow these best practices to ensure your surveys are successful:

1. Define Clear Objectives: Before you even start designing your survey, ask yourself: What specific information do you need? Are you trying to measure overall satisfaction with a new product launch, identify bottlenecks in your customer service, understand feature usage, or gauge brand perception? Having clear, focused objectives will guide every other decision, from question selection to distribution channels.

2. Know Your Audience: Tailor your survey to the demographic and psychographic profile of your target audience. Consider their likely pain points, communication preferences, and the time they are willing to invest. A concise survey might be better received by busy professionals, while slightly more detailed ones might work for a more engaged user base.

3. Keep it Concise and Focused: Respect your respondent’s time. Aim to keep surveys short, typically under 5-10 minutes. Prioritize essential questions and eliminate anything that doesn’t contribute directly to your objectives. Use a logical flow, grouping related topics together.

Designing Effective Questions

The heart of any successful survey lies in its questions. Focus on clarity, relevance, and neutrality: Mcdvoice.com Customer Survey and Coupon Code

a. Use Simple and Clear Language: Avoid jargon, technical terms, slang, and complex sentence structures. Ensure questions are easily understandable by everyone. Brazzers Survey Advertisement: Exploring Online Consumer Preferences

b. Be Specific and Targeted: Instead of asking broadly “How satisfied are you?”, ask about a specific experience: “How satisfied were you with the resolution provided by our customer service team?”

c. Avoid Ambiguity and Bias: Frame questions neutrally, avoiding leading language or loaded questions. For example, instead of “Didn’t our product perform flawlessly?”, ask “How would you rate the performance of our product?”

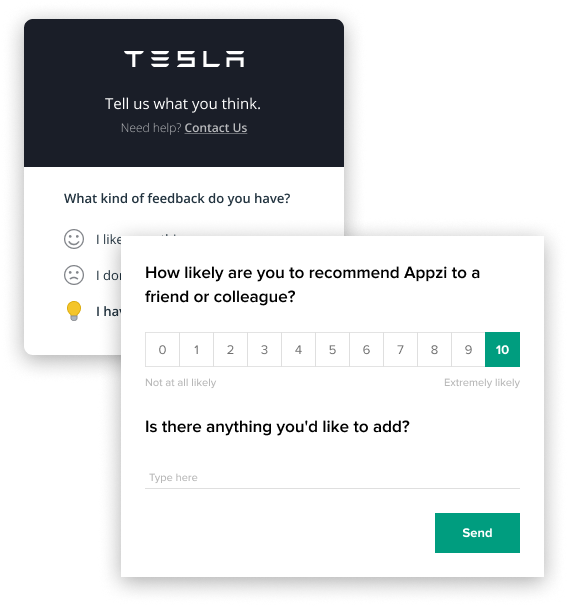

d. Utilize a Mixture of Question Types: Incorporate different question formats to gather both quantitative and qualitative data. Common types include:

- Multiple Choice (Single Select): Ideal for gathering quantifiable data on specific aspects (e.g., “On a scale of 1-5, how likely are you to recommend us?”).

- Multiple Choice (Multiple Select): Allows respondents to choose more than one answer, useful for identifying preferences or priorities.

- Rating Scales (e.g., Likert Scale): Measure attitudes towards specific statements or aspects (e.g., “How satisfied are you with our website navigation?” – options typically range from Strongly Disagree to Strongly Agree).

- Open-ended Questions: Crucial for capturing detailed feedback, suggestions, and specific examples that quantitative data might miss. Use these sparingly, typically at the end of the survey.

- Ranking Questions: Ask respondents to prioritize a list of items (e.g., “Please rank the following factors in order of importance for your decision to purchase from us:”).

e. Pilot Test Your Survey: Before launching your survey to a wide audience, conduct a pilot test with a small group of representative users. This helps identify confusing questions, technical glitches, and potential biases. Use their feedback to refine the survey before the main launch.

Choosing the Right Distribution Channels

How you distribute your survey impacts response rates and the type of feedback you receive:

a. Email: A widely used and effective channel. Personalize the invitation, clearly state the survey’s purpose and expected time commitment, and use a compelling subject line. Ensure the email is mobile-friendly.

b. Website Pop-ups/In-page Prompts: Can capture feedback immediately after a key interaction, such as completing a purchase or submitting a support ticket. Be mindful not to be overly intrusive.

c. In-app Messages: Similar to website pop-ups, these can prompt users for feedback directly within your software or application.

d. Social Media Polls and Surveys: Useful for gathering quick feedback and reaching specific audience segments, but generally limited in length and complexity.

e. Link in Customer Journeys: Include survey links in follow-up emails after specific interactions (e.g., post-purchase, after support resolution) to gather feedback on those particular experiences.

Timing Matters

When you ask your customers for feedback is just as important as what you ask. Collect feedback:

- Timely: Gather feedback soon after the relevant interaction (e.g., purchase, support contact) while the experience is still fresh in their minds.

- Contextually Relevant: Frame the request within the context of their recent interaction. For example, “We value your opinion! Could you share your experience with our recent support call?”

Acting on the Feedback

The most crucial step often overlooked is taking action. Conducting surveys is futile if you don’t use the results to make tangible improvements. Share survey findings internally, connect feedback to specific teams responsible for making changes, and communicate back to customers that their input has been received and acted upon. This demonstrates accountability and reinforces the value of their feedback.

Conclusion: Turning Feedback into Actionable Insights

Customer feedback surveys are far more than just a box-ticking exercise; they are a vital mechanism for understanding your customers and driving business growth. By strategically implementing surveys with clear objectives, well-crafted questions, and appropriate distribution channels, you can unlock a wealth of insights.

The key lies in consistently asking for feedback, listening attentively to the responses, and most importantly, acting on them. Customer feedback surveys empower you to identify friction points, validate successes, prioritize improvements, and ultimately, deliver a superior customer experience. In an era defined by customer choice, those organizations that actively listen and adapt based on direct customer input will undoubtedly thrive