Dressing up in trendy and fashionable clothes makes you feel good, right? Being sharp and confidence requires you to wear clothes that suit you. Finding clothes to wear can be a hustle and that is why old navy stores are there for you. If you love the latest clothes, I know you visit their stores to shop.

Dressing up is an everyday thing. You need to feel and look good. Whether on a t-shirt, jeans denim, kids’ clothes or maternity wear, you and your family need an old navy to satisfy your clothes need. It is a place you and your family can find all the latest fashionable clothes and accessories.

When you walk into their stores, all you will find is classy, fashionable, and trendy clothes. They are associated with Gap and their mission is to offer you and your family modern clothing for you to wear at a pocket-friendly price. If you love shopping with them, you will find the experience worth.

Do you find yourself unease carrying cash when going to shop in their stores? Do you want an alternative that will keep your money safe and earn you points? Old navy understands carrying cash around comes with its disadvantages that are why they have the Old Navy Credit Card. Do you want to know more about it? Scroll along.

What is Old Navy Credit Card?

You probably have a credit card right now. How do you use it? Shop with it right? Yes, a credit card is a preloaded card for you to use. You buy goods and services with the card. Your financial institution is responsible for giving you the card and loads it for you to use.

An Old Navy Credit Card is a card that synchrony financiers give you on behalf of old navy stores for you to shop with. The card is loaded with cash every month for you to shop for clothes at old navy stores and their associates.

Depending on the card you will get after application, you will be able to buy clothes and accessories from their stores and then you will pay ay the end of the month just like any other credit card. How do you get the credit card? You are asking that right? Here is how.

How to get an Old Navy Credit Card

For you to get an Old Navy Credit Card, you must apply for it. You walk into any of their stores and the workers here will assist you in the application process. You can also go through the synchrony bank website where they have the whole process of application.

You may think the application process is complicated but actually, it is not. All they have is a waiting period for them to check on your creditworthiness before they can give you the card. Though they have different kinds of credit cards, you don’t get to choose the credit card that you will get.

The type of credit card you get will depend on your creditworthiness. Those with good creditworthiness get the old navy visa card while those with fair get the normal Old Navy Credit Card. If you have a good credit score, you will get your card easier than those with a fair or bad credit score.

Types of Old Navy Credit Cards

Before you go ahead and apply for the card, it is good to know what they have. Like mentioned earlier, they have a variety of credit cards for you to have. The type of card you get depends on your credit score and the number of points you have with your first credit card.

It is good to check and evaluate your credit score before you start the application process. That is because depending on financial advisors, the card can be hard to maintain if you are struggling with your finances. Synchrony bank has the following types of credit cards;

- Normal Old Navy Credit Card

It is a normal credit card you will get if you have an average credit score. The store-branded card you get will be for shopping with it hat you ant in their stores. The card is limited in that you can only shop in speculated shops only.

That does not mean you will not shop at your favourite old navy shop with it. It means you can only use it in old navy stores, Gap stores, banana republic, and athlete. If you are a frequent shopper in the stores, then you have a lot to gain from the card. It also has benefits that you will see below.

- Old Navy visa credit card

It is also a store-branded credit card you get from the synchrony bank. If you get the card, it means your credit score is above average or good. While the normal credit card you get restricted to here you use the card, in the visa one, you don’t. What does that mean?

It means when you get the card, not only can you use the card to shop on old navy and Gap associate stores, you also get to use the card as a visa card. That means you can fuel, buy grocery, and make many more payments with the card. That makes it convenient to have since it has multiple uses.

- Navyist

When it comes to navyist card, you don’t apply for it. It is a card you get earn once you achieve a certain number of points. It is a status card since it shows how loyal you have been to a group of stores. For you to get the card, you must have;

- Over 5000 points excluding bonus points and returns within a year.

- You must have proven to be making payment before the due day every month.

- Have been maintaining a good standing of your account.

With the card, you will get all the benefits that come with a normal old navy credit card. On top of that, you will have added advantages and rewards for owning that card that you shall see below. That makes the card more beneficial for you to have and shop with.

- Navyist visa credit card

It is an upgraded version of the old navy visa. You get the card after you have been a royal visa cardholder and have proven to have an account of good standing. It means constant earning of points and payment on time.

Earning the card comes with its benefits. Not only do you have the visa credit card benefits, but you also have more added ones that will help you shop out of old navy stores and their associates. You will have more use of the card than any other card.

Old Navy Credit Card

6 Main Old Navy Credit Card Benefits

What will you get with the card? It is the question you need to have in mind when applying for the card. Yes, it is true having a credit card is convenient, safe, and fraud-free, but what else will you get with the Old Navy Credit Card?

While reading below, it is important to note that the benefits you get depend on the credit card you will get from the bank. Other cards have more benefit than others. You will have to work with what you get and strive to earn the others. The following are the benefits of Old Navy Credit Cards;

- Earn points

Yes, it is the only sure way that you will get a discount on the points you earn. In all the cards you get five points for every $1 you spend in the old navy stores and the gap group of stores. For the old visa card and navyist visa, you get an extra 1 point for every $1 you spend outside of their stores.

Once you accumulate the points, you can redeem them for discount rewards. For every 500 points you have, you will get $5 to spend on heaver item you ant in their stores. If you are a fun of the stores, you have more to gain since you will be earning more points each time you use the card.

- 20% off first purchase

If you are planning to change your wardrobe, getting gone of the cards will come in handy no. that is because after you get any of the cards, you get a 20% off your first purchase with the card. Now, that is a huge saving if you are planning on making a big purchase.

- Earning bonus points

You are set to gain more bonus points each time you use the card. You will get the bonus randomly hen the stores have the offers. As you shall see below, it is good to keep track of what the stores are offering with your mobile app or having an account online for alerts.

- 60 days 10% off pass

It is a promotion that old navy and the Gap group of stores have for their customers. With the card, you get to have 60 days of shopping at 10% off per purchase. The benefit applies to all cardholders. Using the card means you will get more during the off days for you to remain trendy.

- The special event, discount and promo codes

For Visa cardholders, you have an added advantage of having special invitations to events, to shop at a discount and have direct promo codes sent to you. That only means that the card will give you more chances of shopping for less and saving more.

- Other benefits

You also get many more discount and shipping benefits. Universal benefits that some all the cards include;

- Zero fraud liability.

- Chip and sign technology.

- Card notification and enquiring services.

Managing your old navy credit account

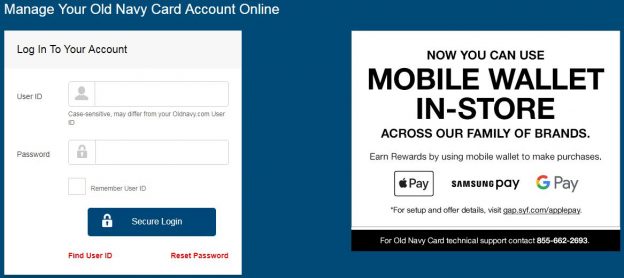

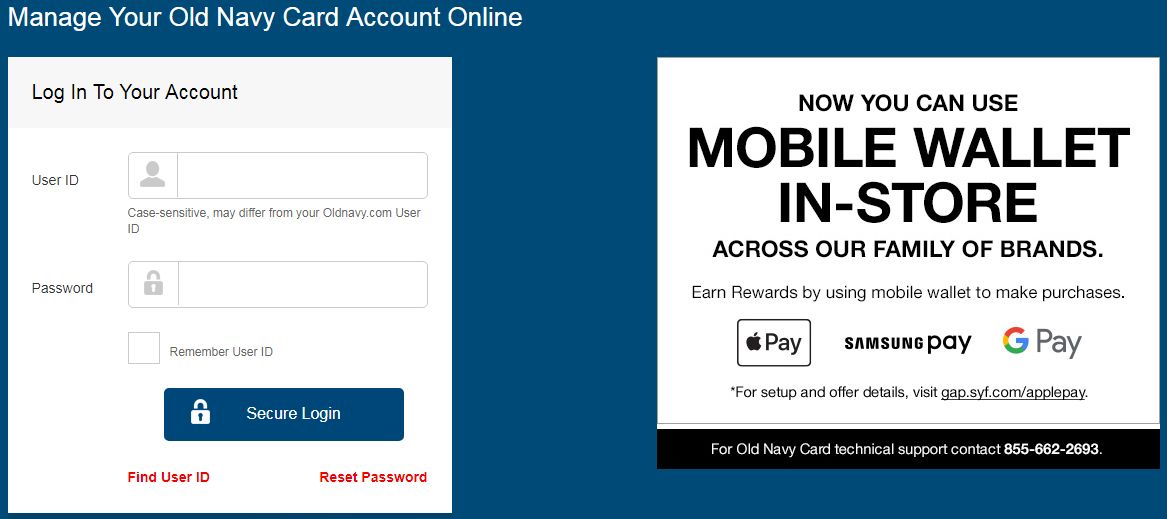

After you get the card, you need to have a way of managing your credit card account. Synchrony bank provides a platform for old navy cardholders to be able to keep track of their cards activities. Through the platform, you can be able to;

- View all your cards activities.

- You can get all your billing statements.

- You can set up a paperless statement for the extra point.

- Set to get alert on upcoming events, promos, and discounts.

For you to have an online account, you must go to the bank’s website and register your account. If you already have one, to access your account, you just need to log in using your user name and pin. With the platform, you can easily manage your card online.

You can also manage your account by having a mobile application. In your tablet, iPhone, or Android phone, you can be able to receive alerts, track your rewards progress, and view your statements. It sounds good to have control at the tip of your hands, right?

Disadvantages of having the Old Navy Credit Card

- High APR

Though having the cards has its own benefits, it has its own setbacks. Financial advisors will advise you to stay away from the card if you are struggling financially. That is because the card has a high APR than any other card store banded card making it expensive to have.

- Limited

Depending on the cad you have, you will be limited to use the card in a certain store. If you are not a fan of buying clothes or you are more into grocery stores and not into buying clothes, having the card will limit you. Many people have an average credit score meaning they get the normal old navy card, which is limited.

- Rewards restriction

They have a strict policy of ho and here you will use your rewards. You can only use your rewards in store at the old navy and Gap group of stores. You can only redeem 5 rewards at a time and the rewards expire. Those are setbacks that come with the card.

If you like having a modern wardrobe of any kind, old navy, and Gap group of stores must be your place to shop. With all the trendy fashionable clothes they have, your family will benefit from the store. Having an Old Navy Credit Card will make your shopping experience pocket-friendly and easier for you.